Printable W 4

- clara

- Posted on

Hey there! So you’re looking for a printable W-4 form, huh? Well, you’ve come to the right place! Let’s dive into what you need to know about this important document.

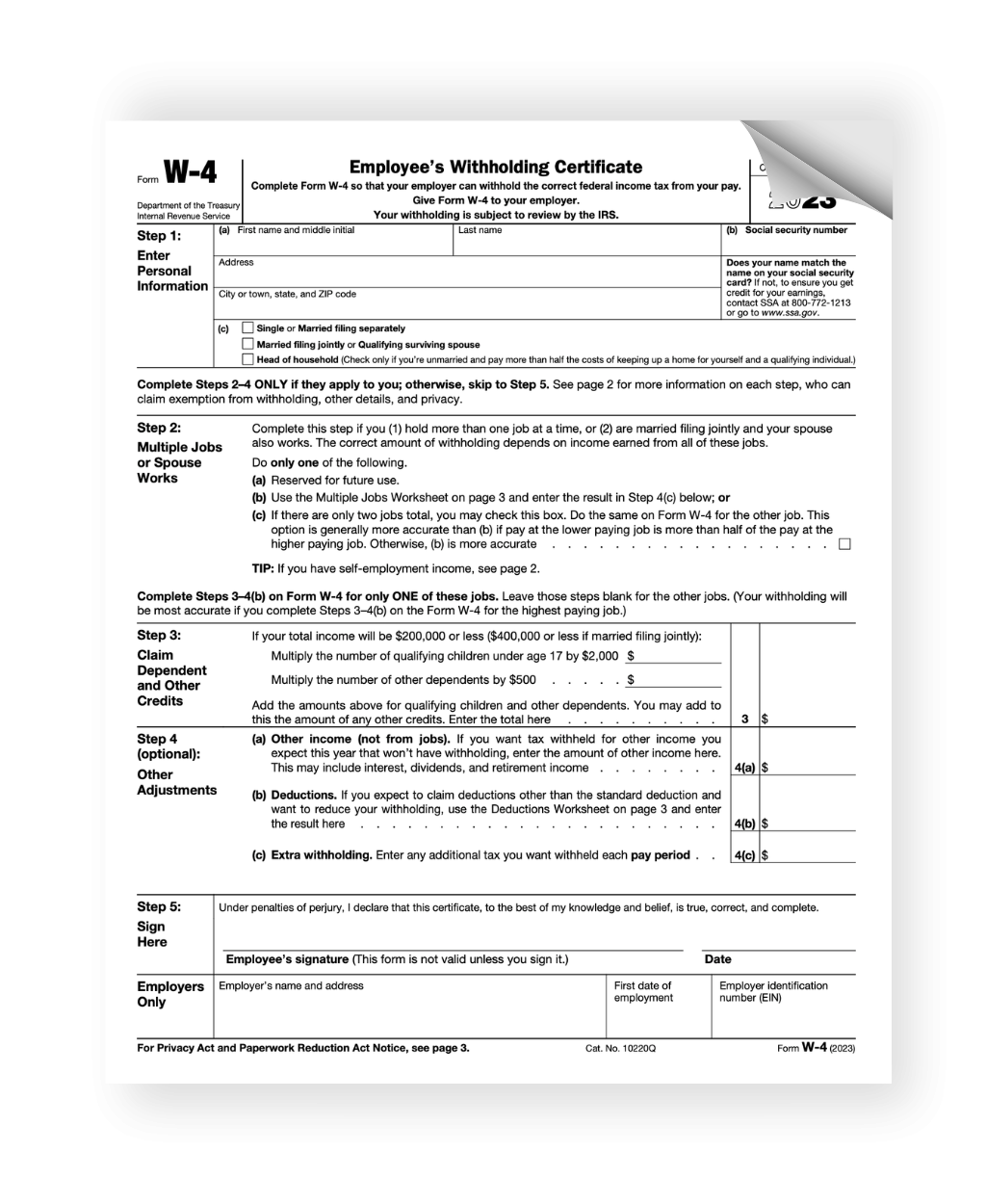

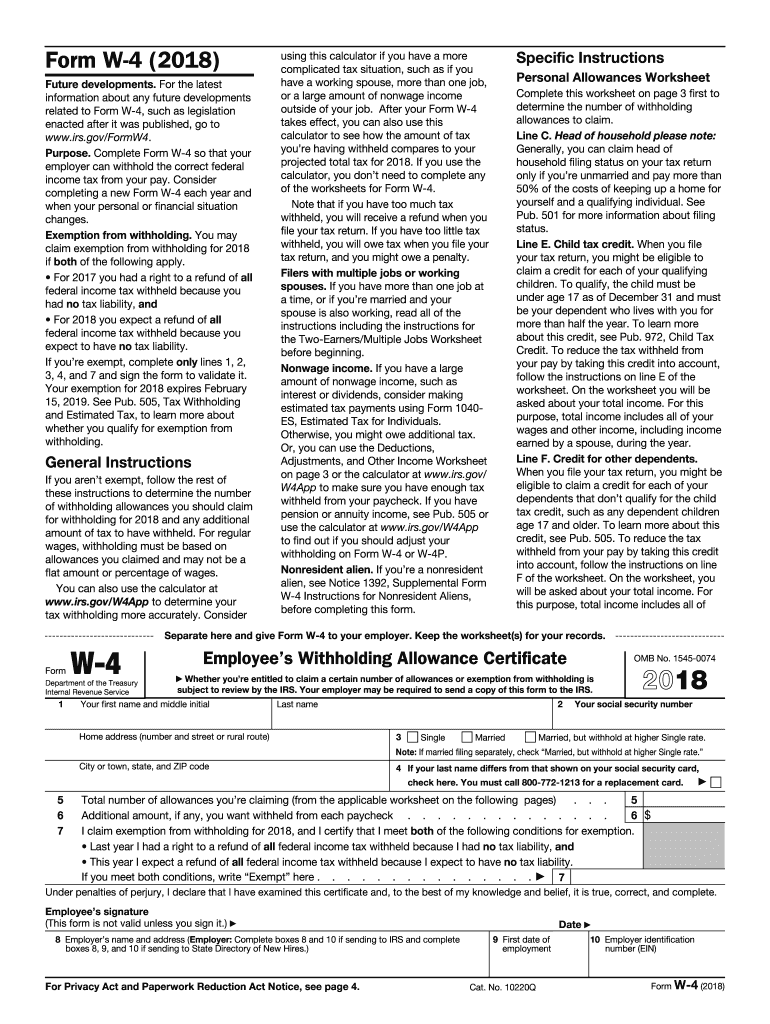

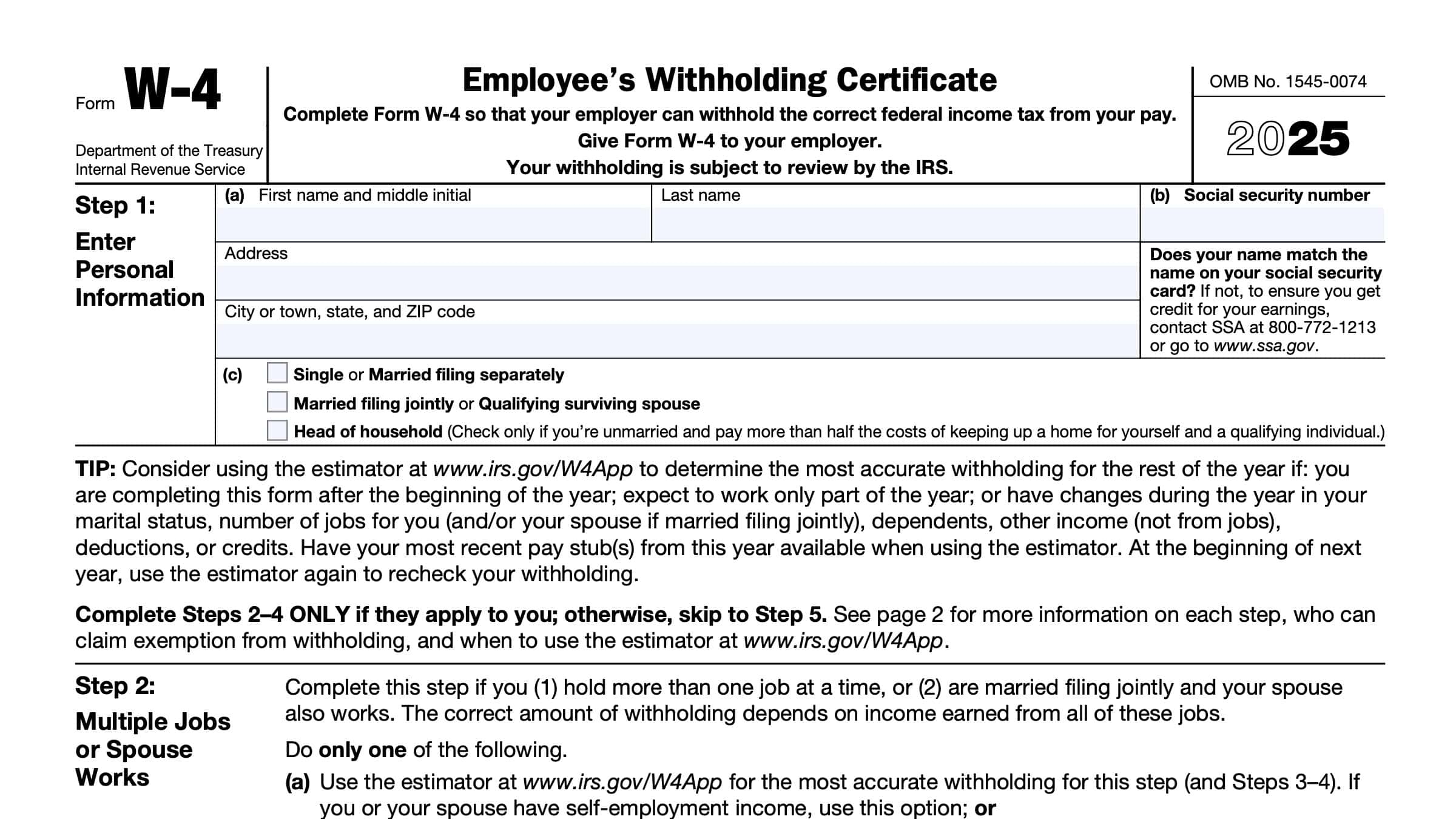

First things first, what exactly is a W-4 form? It’s a form that employees fill out to let their employers know how much federal income tax to withhold from their paychecks. In other words, it helps ensure you’re paying the right amount of taxes throughout the year.

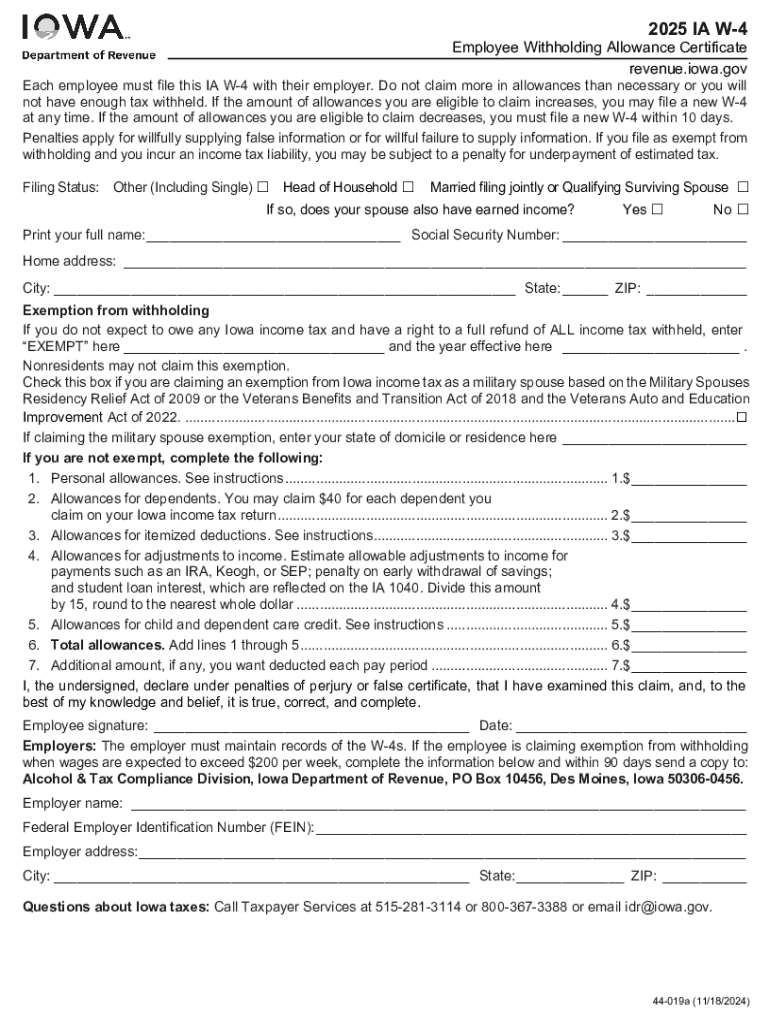

printable w 4

Where to Find a Printable W-4 Form

If you need a printable W-4 form, you can easily find it on the IRS website. Just go to their Forms & Publications section, look for Form W-4, and download the PDF. It’s that simple!

Once you have the form, you’ll need to fill it out accurately. Make sure to provide all the necessary information, including your filing status, number of allowances, and any additional withholding amounts. If you’re not sure how to fill it out, don’t hesitate to ask your HR department for guidance.

Remember, it’s important to review and update your W-4 form regularly, especially if you experience any major life changes, such as getting married, having a child, or taking on a second job. Keeping your form up-to-date can help prevent any surprises come tax time.

So there you have it! Now you know where to find a printable W-4 form and how to fill it out correctly. By taking the time to complete this form accurately, you can ensure that your tax withholding aligns with your financial situation. Happy filing!

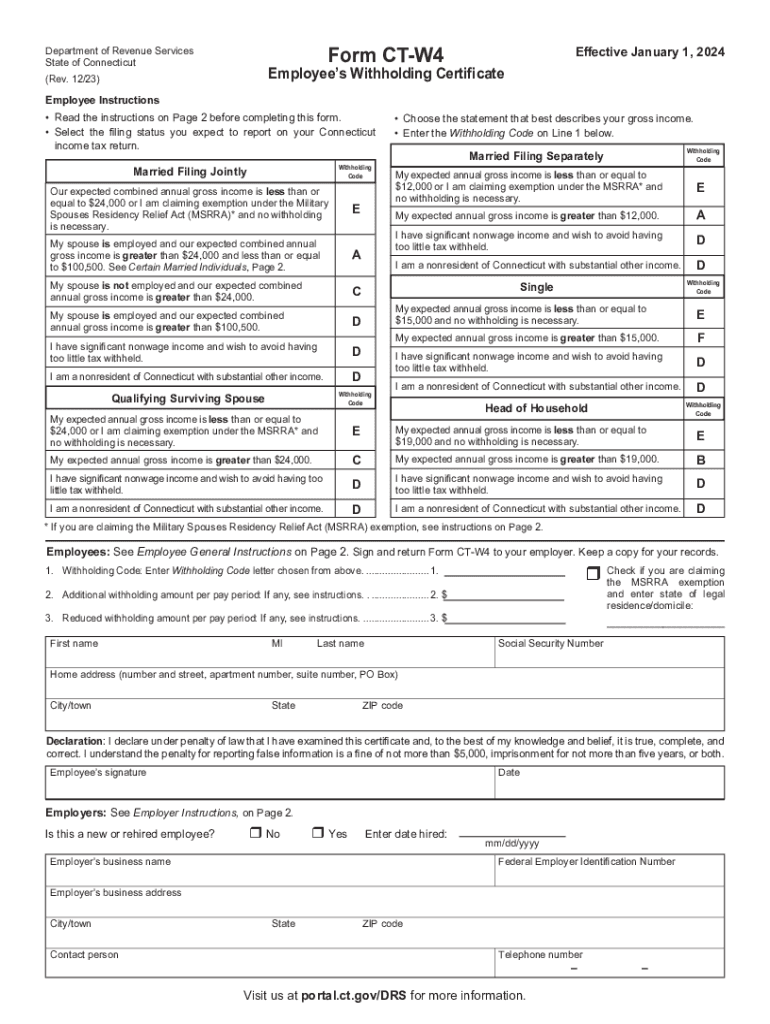

2023 2025 Form CT DRS CT W4 Fill Online Printable Fillable Blank PdfFiller

Useful IRS Forms

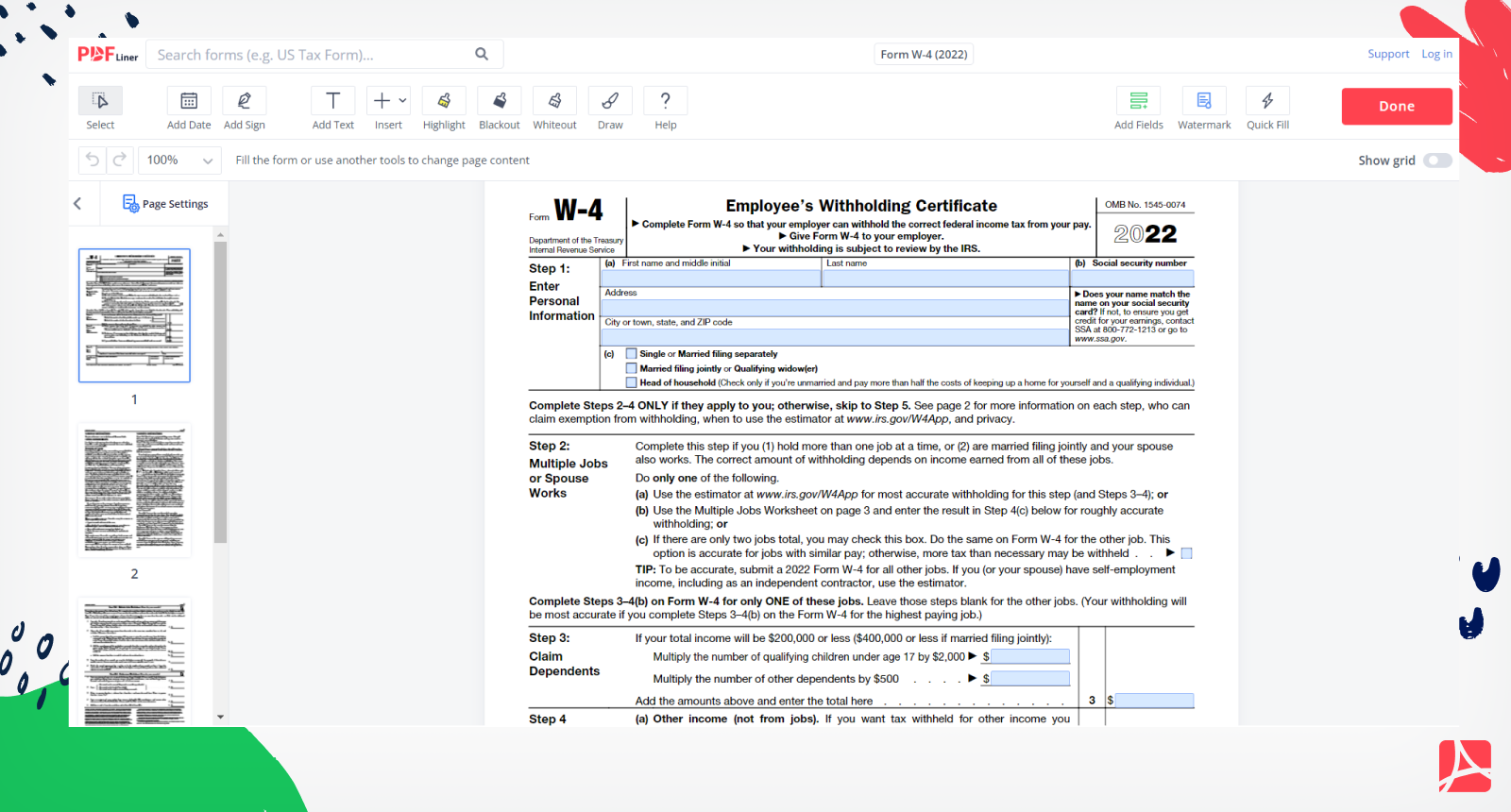

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

W 4 Form 2024 Printable Fill Out Sign Online DocHub

IRS Form W 4 Instructions Employee s Withholding Certificate